Polskie regulacje w sprawie opodatkowania dochodów uzyskiwanych poprzez kontrolowaną spółkę zagraniczną

Z dniem 1 stycznia 2015 r. weszły w życie przepisy przewidujące opodatkowanie przez polskich podatników dochodów uzyskiwanych poprzez zagraniczne spółki kontrolowane (Controlled Foreign Corporation – CFC). Zgodnie z polską ustawą o podatku dochodowym od osób prawnych za zagraniczną spółkę uznaje się: osobę prawną, spółkę kapitałową w organizacji, transparentną podatkowo spółkę, jeżeli jest traktowana przez […]

Achieving Substance in Cyprus

Introduction The intensifying initiatives in global tax reforms like the Base Erosion and Profit Shifting (BEPS) initiative created by Organisation for Economic Cooperation and Development’s (OECD) along with many of localized tax reform efforts, create a negative impact for multinational businesses. In addition, it is more popular that the countries implement Controlled Foreign Company (CFC) […]

London Office Opening – Announcement

At IBCCS we are happy to announce the opening of our London office in order to enhance our presence within the region and further augment our services for clients in one of the world’s most influential financial centres, to offer our professional services which include: Registration and management of companies and partnerships; Legal & […]

Implementation of CRS in Cyprus as of 1 January 2016

In order to protect the integrity of tax systems and the fight against tax avoidance, governments around the world bring the standard automatic exchange of information in tax matters called Common Reporting Standard (CRS). The CRS is a set of global standards for the automatic exchange of financial information, developed by the Organization for Economic […]

Annual Levy of EUR 350.00 – companies registered in Cyprus

Please be informed that as per the Article 391 of the Companies law (as amended Law No. 6(I)/2013), it is obligatory to pay the annual fee (Annual Levy) for all companies registered in Cyprus. The fee equals to EUR 350.00 (three hundred and fifty euros) and has to be paid to the Registrar of Companies […]

Tax avoidance vs. tax evasion

The difference between those two is crucial. While tax avoidance is legal, tax evasion is not. It is understandable that the local governments try to fight with both, however very often it is a long-term and complicated process. In the meantime, the taxpayers might enjoy their attempts to pay less taxes. Let’s look at both […]

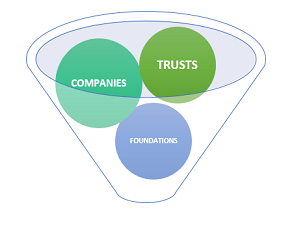

Types of entities available offshore

In typical offshore jurisdiction, the types of entities available often include the same entities (like various types of companies and partnerships) which are available elsewhere. They may however have different characteristics & regulations and may be treated differently by local law than the same entities in other countries. While companies are the most popular vehicles […]

Why companies & individuals go offshore?

There are various benefits for companies and individuals going offshore, but the most popular one is the possibility to reduce or avoid taxes. Tax avoidance was, is, and will be the most important reason for going offshore. We can mention some other reasons like e.g. protection of assets, holding of investments, using the offshore company […]

Offshore financial centre – defined

There are many debates on how the ‘offshore financial centre’ should be defined. Should people say ‘offshore centre’, ‘tax haven’, ‘low tax jurisdiction’, ‘offshore zone’ or the other combination? And what do they really mean? They all relate to similar area, but there are slight differences between some of them (which I will explain in […]