Updated for the Cyprus tax reform effective from 1 January 2026.

If you’re searching for “Cyprus personal income tax”, you typically want three things: the current tax rates, the tax brackets, and a simple explanation of how the calculation works in real life. Cyprus is relatively straightforward once you understand one key concept: it’s a progressive system, meaning higher rates apply only to the part of your income that falls into higher bands. If you’re based in Cyprus or relocating, you can also explore our Cyprus services and practical support.

-

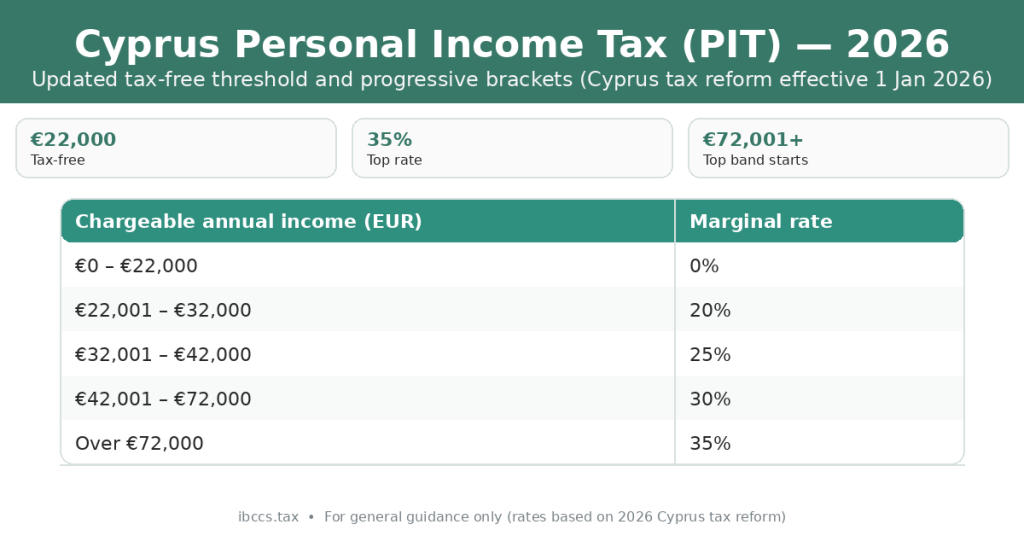

The tax-free threshold is €22,000 (chargeable annual income).

-

Cyprus uses progressive tax brackets (moving into a higher band does not tax your whole income at that rate).

-

The top 35% band applies only to income above €72,000.

-

The reform introduced family and household reliefs (children, primary residence support, energy upgrade/EV), subject to conditions.

-

Some personal income topics (e.g., dividends) may involve SDC rules in addition to PIT, depending on your status and income type.

-

Tax return submission is legislated as mandatory for Cyprus tax residents aged 25+ (implementation details/exemptions may apply in practice).

This guide explains Cyprus personal income tax (PIT) in 2026, what changed after the reform, and the practical points that matter for employees, self-employed individuals, and new arrivals.

What is personal income tax in Cyprus?

Table of Contents

TogglePersonal income tax (PIT) is the tax individuals pay on their chargeable income for the year. In everyday terms, PIT is most relevant for:

-

salary and employment benefits,

-

self-employment / business income,

-

certain pensions and recurring income.

What matters in practice is how your income is classified, because Cyprus can apply different rules to different income categories (for example, certain passive income streams may be handled under separate provisions).

Cyprus personal income tax rates 2026 (tax brackets)

| Chargeable annual income (EUR) | Marginal rate |

|---|---|

| €0 – €22,000 | 0% |

| €22,001 – €32,000 | 20% |

| €32,001 – €42,000 | 25% |

| €42,001 – €72,000 | 30% |

| Over €72,000 | 35% |

These brackets and the higher tax-free threshold form a core part of the 2026 Cyprus tax reform.

What “marginal rate” means?

Your marginal rate is the rate applied to the next euro you earn. If you enter a higher band, only the income above that band’s threshold is taxed at the higher rate.

How to calculate Cyprus income tax (simple examples)

To estimate PIT, you apply each rate to the portion of income that falls into that band.

Example 1: chargeable income €40,000

-

€0–€22,000 at 0% → €0

-

€22,001–€32,000 at 20% → €2,000

-

€32,001–€40,000 at 25% → €2,000

Estimated PIT: €4,000

Example 2: chargeable income €90,000

-

€0–€22,000 at 0% → €0

-

€22,001–€32,000 at 20% → €2,000

-

€32,001–€42,000 at 25% → €2,500

-

€42,001–€72,000 at 30% → €9,000

-

€72,001–€90,000 at 35% → €6,300

Estimated PIT: €19,800

These are simplified illustrations to show how the brackets work. Your actual outcome depends on your final chargeable income, reliefs and the exact classification of income.

Who pays personal income tax in Cyprus?

Your personal tax position typically depends on tax residency and the source/type of income.

Cyprus tax residents

If you are considered tax resident in Cyprus, your annual income is assessed under Cyprus rules for the year (and you may be required to file a return even if no tax is due).

If you want to keep things simple and compliant, we can handle personal income tax return preparation and filing.

Non-residents

If you are not Cyprus tax resident, Cyprus may still tax certain Cyprus-sourced income (the outcome depends on the category of income and the facts).

Cyprus tax residency: why it matters

Many internationally mobile individuals focus on the 183-day test and the 60-day test. In practice, if you have strong ties to another country, you also need to think about double tax treaty tie-breakers and evidence (home, work, family, centre of life). This is where professional review usually saves time and prevents disputes later.

What changed after the 2026 Cyprus tax reform (individuals)

The 2026 reform is not only about new brackets. It also introduced targeted reliefs and compliance updates that many households will notice.

1) New family and household tax reliefs (2026)

The reform includes allowances and deductions (subject to eligibility criteria), such as:

-

child allowances per parent (based on family income thresholds),

-

a deduction (capped) linked to primary residence financing/rent,

-

a deduction (capped) for energy upgrading of a primary residence or purchase of a new electric vehicle,

-

expanded deductibility for certain insurance premiums.

These reliefs are documentation-driven, so it helps to organise contracts and proof of payments throughout the year — especially if you want them reflected correctly in your annual return.

2) Personal tax isn’t only PIT: dividends and certain passive income

People often search “income tax” but actually mean “how will Cyprus tax me overall?”. Cyprus can apply separate provisions to certain passive income streams (commonly discussed under SDC rules), and the reform introduced notable updates in that area as well.

If you have income from dividends, interest, or rental activity, it is worth reviewing how each stream is treated so you don’t rely on outdated or oversimplified assumptions.

3) Mandatory tax return filing (bigger compliance focus)

The reform package legislates broader reporting, including mandatory submission of income tax returns for Cyprus tax residents aged 25 and above, regardless of taxable income (with practical details and possible exemptions typically clarified through implementation practice and decrees).

Cyprus income tax on salary (employees)

For most employees, the experience of PIT in Cyprus is predictable:

-

the first part of chargeable income can be tax-free (up to €22,000),

-

tax then increases gradually through the bands,

-

only the top slice (if applicable) falls into the higher rates.

If you are relocating for work, Cyprus is also known for specific employment incentive regimes for qualifying individuals. These are not “automatic” – the conditions and correct implementation matter – but they can materially change the net outcome for eligible employees.

Common mistakes when people google “Cyprus personal income tax”

These are the most common misunderstandings we see when people research Cyprus personal income tax:

-

“If I hit 35%, I pay 35% on everything.”

No. Cyprus applies marginal rates. -

Confusing gross salary with chargeable income

The bands apply to chargeable income, not necessarily the headline salary number. -

Treating all personal income as PIT

Some income types can follow different rules (and the 2026 reform affected some of those areas). -

Using old bracket tables

Pre-2026 tables still circulate widely online. Use the 2026 bands shown above

Practical checklist for 2026 (residents and new arrivals)

-

Confirm your tax residency position early – especially if you keep strong ties abroad.

-

List your income streams (salary, self-employment, rent, dividends, interest).

-

Keep documentation for any reliefs you may claim (housing, family allowances, eligible upgrades).

-

Don’t wait for filing season to organise records – personal tax is easier when managed throughout the year.

How IBCCS TAX can help

If you want certainty (and fewer surprises), we can:

-

confirm your Cyprus tax residency position,

-

review your income mix and identify what falls under PIT vs other provisions,

-

model an estimated 2026 outcome (including relevant reliefs), and

-

prepare and file your annual personal tax return correctly.

FAQ: Cyprus Personal Income Tax (2026)

1) What is personal income tax in Cyprus?

Personal income tax (PIT) in Cyprus is a progressive tax charged on an individual’s chargeable annual income. Different parts of your income are taxed at different rates, depending on which band they fall into.

2) What is the tax-free threshold in Cyprus in 2026

In 2026, the first €22,000 of chargeable annual income is taxed at 0%. This threshold was increased under the Cyprus tax reform effective from 1 January 2026.

3) What are the Cyprus income tax rates for individuals in 2026?

The 2026 marginal rates are 0%, 20%, 25%, 30%, and 35%, applied progressively across income bands.

4) If I earn more than €72,000, do I pay 35% on all my income?

No. Cyprus uses marginal tax rates. The 35% rate applies only to the portion of your chargeable income above €72,000, not your entire income.

5) What does “chargeable income” mean in Cyprus?

“Chargeable income” is the portion of your annual income that remains taxable after allowable deductions and reliefs. For many people, it’s not exactly the same as gross salary, especially if reliefs apply or if income includes items taxed differently.

6) Do employees in Cyprus pay personal income tax?

Yes, employees can pay PIT on their chargeable employment income. In 2026, part of chargeable income may be tax-free up to €22,000, then taxed progressively through the bands.

7) Are there tax deductions or allowances for families in Cyprus (2026)?

The 2026 reform package includes reliefs such as child-related allowances (subject to criteria) and other household-focused deductions (conditions and thresholds apply).

8) Do I need to file a personal tax return in Cyprus?

The reform package legislates mandatory return filing for Cyprus tax residents aged 25+, regardless of taxable income (implementation details and exemptions may apply).

Our Publications

Cyprus Personal Income Tax in 2026: Rates, Tax Brackets and What Individuals Should Know

Updated for the Cyprus tax reform effective from 1 January

Read MoreCyprus Stamp Duty for Property Buyers: Abolished from 1 January 2026 (What It Means for Buyers)

Cyprus stamp duty for buyers has been abolished from 1

Read MoreCyprus Minimum Wage 2026: Current Rates, Who It Applies To and What Employers Should Do

Cyprus updated the national minimum wage from 1 January 2026.

Read More