Register of Beneficial Owners – the final electronic system

The Department of the Registrar of Companies and Intellectual Property in Cyprus announced the start of the application of the final solution for the Register of Beneficial Owners from November 14, 2023. The final solution of the electronic system of the Register of Beneficial Beneficiaries is replacing the so-called “interim solution” that had been operating since March 12, […]

Increase in Social Insurance Contributions from January 2024

As per the Social Insurance Law in Cyprus, starting January 1st, 2024, both employer and employee will be required to contribute an additional 0.5% to the Social Insurance Fund. Therefore, contributions will increase from the current 8.3% to 8.8% on employees’ Insurable earnings. The rate will thereafter increase by 0,5% every five years, until it reaches 10,3%, as […]

Amendment to the Special Defence Contribution Law

Special Contribution for Defence (SDC) is dictated on income earned by Cyprus tax residents. On 9 June 2023, amendments to the Special Contribution for the Defence Law were published in the Cyprus Government Gazette amending the obligation to pay the SDC withheld on rents in two semi-annual installments instead of monthly payments. Every person who is obliged […]

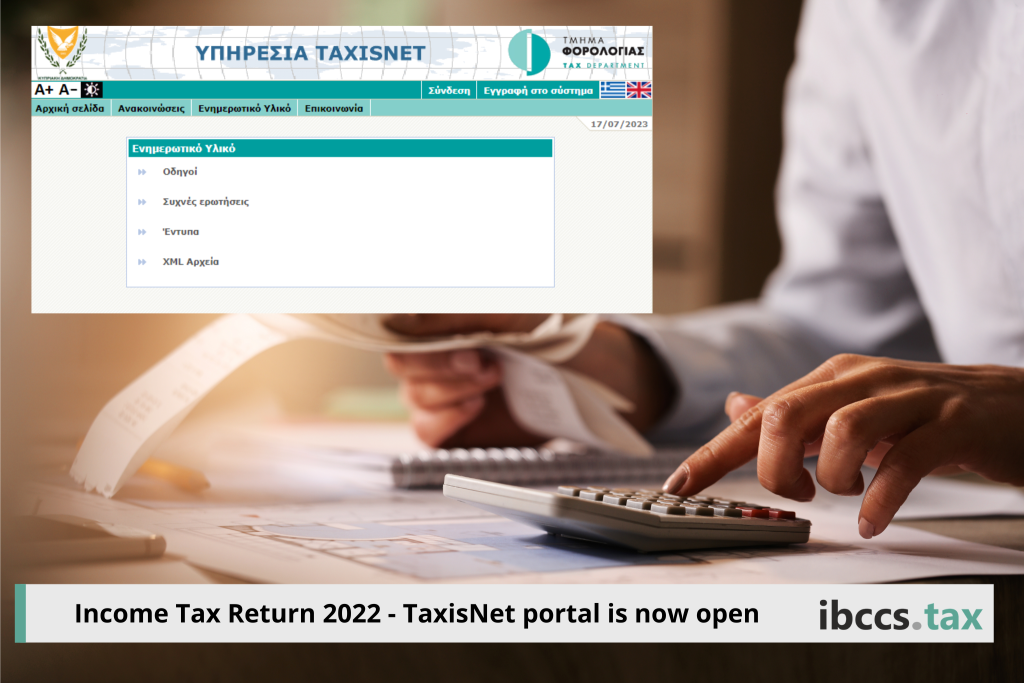

Personal Tax Return 2022 – TaxisNet portal is now open

The submission of the income tax returns for individuals in Cyprus (form IR1) for the year 2022 is now available via TaxisNet portal. We would like to remind you that the deadline for the submission of the 2022 Personal tax return has been extended until 2 October 2023, as per the decree (No.183/2023) issued on 9 […]

50% Expatriate Relief on Employment Income in Cyprus – new tax incentive law now published

The amending income tax law of Article 8(23A) was published on 30 June 2023 and has a retrospective effect as from 1 January 2022. As from 1st January 2022, according to Section 8(23A) of the Cypriot Income Tax (“ILT”), 50% of the gross remuneration from first (1st) employment* exercised in Cyprus, is exempt from personal income tax. This applies […]

CYPRUS: PROVISIONAL TAX 2023

Cyprus companies are required to apply a temporary tax assessment / calculation of their 2023 chargeable income under the Cyprus Income Tax Law. The temporary tax assessment/estimation is due in two equal instalments on or before following dates: 31st of July 2023, 31st of December 2023. If provisional tax payments were made based on an incorrectly calculated […]

Extension to the filing date of Income Tax Return (IR1 2022)

We would like to inform you that the deadline for the submission of the 2022 Personal Income Tax Return (T.D. 1 Form) in Cyprus has been extended until 2 October 2023, as per the decree (No.183/2023) issued on 9 June 2023. The extension also applies to the payment of the related income tax due via self-assessment. […]

Tax-Free No More: Clarifying UAE’s Ground-breaking Corporate Tax Shift

A major shift is happening in UAE. The Federal Tax Authority (FTA) will introduce a 9% corporation tax. We are explaining the implications of this substantial policy change. This new mandate is applicable to all business entities across the UAE, including those within onshore and Free Zone jurisdictions. Who is affected? On-shore entities, as […]

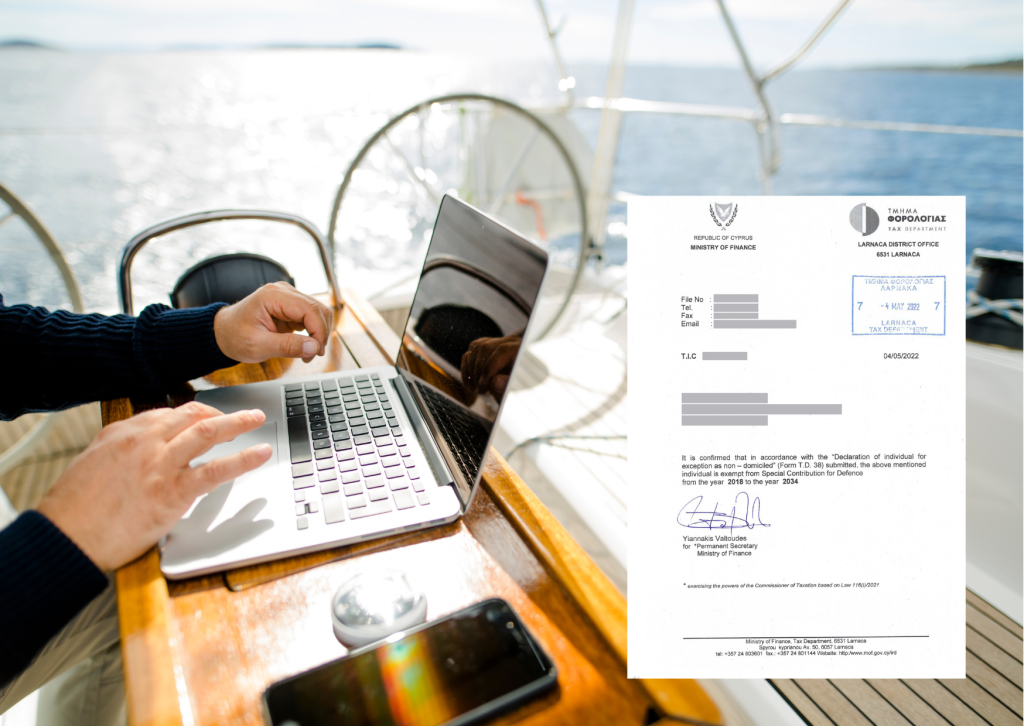

Non – Domicile Regime in Cyprus

𝐇𝐨𝐰 𝐭𝐨 𝐜𝐨𝐧𝐟𝐢𝐫𝐦 𝐲𝐨𝐮𝐫 𝐍𝐨𝐧-𝐃𝐨𝐦 𝐬𝐭𝐚𝐭𝐮𝐬 in Cyprus? A person who is a tax resident in Cyprus is liable to pay Cyprus Income Tax (CIT) on their worldwide income, from all sources. Additionally, domiciled residents of Cyprus pay a Special Defense Contribution (SDC) on their passive income derived from dividends, interest, and rentals as per the following […]

New Immigration Rules for Investment Visa in Cyprus

On 2nd of May 2023, in accordance with the Regulation 6.2 of the Alien and Immigration Regulations, the new requirements for the investment scheme have been officially adopted after the revision by the Council of the Ministers. Category 6.2 (Fast Track Residence) is a permanent residential permit which can be obtained through the investment in the brand […]