Tax and VAT measures of the Cyprus Government

We would like to inform about certain actions implemented by the Cyprus Government in order to support the country’s economy, as a consequence of the unprecedented events of the pandemic. The increased contributions to the General Health Scheme (GHS) will not be applied for April, May and June as originally planned. Extension of the deadline submission of the […]

ECONOMIC SUBSTANCE REGULATIONS

New regulations in key offshore jurisdictions including the British Virgin Islands, Cayman Islands, Bermuda, Guernsey, Jersey and Isle of Man, Marshall Islands came into force at the beginning of 2019 which require entities carrying on specific types of business to demonstrate adequate economic substance in that jurisdiction, with reporting requirements commencing in 2020. The rules […]

New Penalty Fees by the Cyprus Registrar of Companies

Below is the list of charges that will be in force on 18 December 2019 in case of late registration. FOR COMPANIES 1. Transfer of Shares: Any transfer of shares of a private company with a share capital shall be notified to the Registrar of Companies within fourteen (14) days from the registration […]

Polskie regulacje w sprawie opodatkowania dochodów uzyskiwanych poprzez kontrolowaną spółkę zagraniczną

Z dniem 1 stycznia 2015 r. weszły w życie przepisy przewidujące opodatkowanie przez polskich podatników dochodów uzyskiwanych poprzez zagraniczne spółki kontrolowane (Controlled Foreign Corporation – CFC). Zgodnie z polską ustawą o podatku dochodowym od osób prawnych za zagraniczną spółkę uznaje się: osobę prawną, spółkę kapitałową w organizacji, transparentną podatkowo spółkę, jeżeli jest traktowana przez […]

Achieving Substance in Cyprus

Introduction The intensifying initiatives in global tax reforms like the Base Erosion and Profit Shifting (BEPS) initiative created by Organisation for Economic Cooperation and Development’s (OECD) along with many of localized tax reform efforts, create a negative impact for multinational businesses. In addition, it is more popular that the countries implement Controlled Foreign Company (CFC) […]

London Office Opening – Announcement

At IBCCS we are happy to announce the opening of our London office in order to enhance our presence within the region and further augment our services for clients in one of the world’s most influential financial centres, to offer our professional services which include: Registration and management of companies and partnerships; Legal & […]

CYPRUS: PROVISIONAL TAX 2015 – FINAL PAYMENT

We would like to remind our clients and contacts about the upcoming deadline for submission of the 2nd declaration concerning provisional tax for the year 2015. Computation of Temporary Tax According to art. 24 of the Assessment and Collection of Taxes Law No.4 of 1978, as amended, the official deadline for submission of the Provisional […]

Annual Levy of EUR 350.00 – companies registered in Cyprus

Please be informed that as per the Article 391 of the Companies law (as amended Law No. 6(I)/2013), it is obligatory to pay the annual fee (Annual Levy) for all companies registered in Cyprus. The fee equals to EUR 350.00 (three hundred and fifty euros) and has to be paid to the Registrar of Companies […]

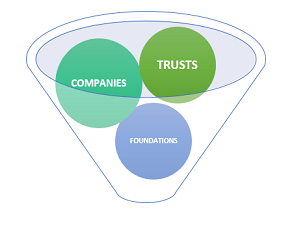

Types of entities available offshore

In typical offshore jurisdiction, the types of entities available often include the same entities (like various types of companies and partnerships) which are available elsewhere. They may however have different characteristics & regulations and may be treated differently by local law than the same entities in other countries. While companies are the most popular vehicles […]

Why companies & individuals go offshore?

There are various benefits for companies and individuals going offshore, but the most popular one is the possibility to reduce or avoid taxes. Tax avoidance was, is, and will be the most important reason for going offshore. We can mention some other reasons like e.g. protection of assets, holding of investments, using the offshore company […]