ATAD 3: economic substance requirements

In December 2021, the European Commission published the first proposal for the Anti-Tax Avoidance Directive 3 (ATAD 3). Its goal is to tackle the abuse of companies that do not carry out any economic activities – namely shell entities. Therefore, the directive is also known as the “Unshell Directive”. The proposal was approved by the […]

Marshall Islands & Substance Reporting

As of November 1, 2023, the Trust Company of the Marshall Islands has implemented a penalty fee of USD 500 for entities failing to adhere to Economic Substance Reporting (ESR). This move comes as part of the country’s commitment to upholding international standards and remaining in the European Union’s whitelist. Reporting obligation Since 2020 […]

UAE Tax Landscape: 9% CIT

The United Arab Emirates is no longer a zero-tax jurisdiction. We were informing about this major shift in our article, back in June 2023: https://ibccs.tax/announcement/uae-corporate-tax/ Certain exemptions apply, however many of the businesses will now pay a corporation tax. On-shore entities, as well as Free Zone entities involved in transactions with on-shore entities, will be subject […]

Tax-Free No More: Clarifying UAE’s Ground-breaking Corporate Tax Shift

A major shift is happening in UAE. The Federal Tax Authority (FTA) will introduce a 9% corporation tax. We are explaining the implications of this substantial policy change. This new mandate is applicable to all business entities across the UAE, including those within onshore and Free Zone jurisdictions. Who is affected? On-shore entities, as […]

Annual Levy for the year 2023

We would like to bring to your attention that according to the Cyprus Company Law, Cap. 113 all Cyprus Companies are subject to an annual government levy of € 350 payable by 30.06.2023. Non-payment of the annual government levy will result in penalties and the de-registration (strike off) of the company from the registry of Cyprus companies. Noting […]

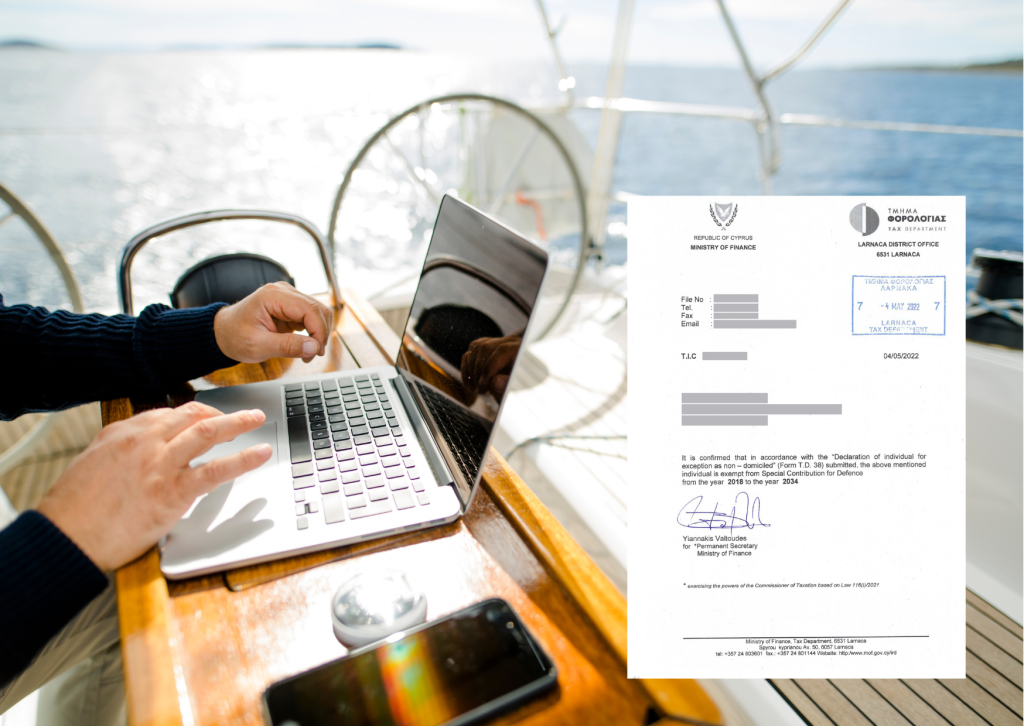

Non – Domicile Regime in Cyprus

𝐇𝐨𝐰 𝐭𝐨 𝐜𝐨𝐧𝐟𝐢𝐫𝐦 𝐲𝐨𝐮𝐫 𝐍𝐨𝐧-𝐃𝐨𝐦 𝐬𝐭𝐚𝐭𝐮𝐬? A person who is a tax resident in Cyprus is liable to pay Cyprus Income Tax (CIT) on their worldwide income, from all sources. Additionally, domiciled residents of Cyprus pay a Special Defense Contribution (SDC) on their passive income derived from dividends, interest, and rentals as per the following rates: Dividends […]

New Immigration Rules for Investment Visa in Cyprus

On 2nd of May 2023, in accordance with the Regulation 6.2 of the Alien and Immigration Regulations, the new requirements for the investment scheme have been officially adopted after the revision by the Council of the Ministers. Category 6.2 (Fast Track Residence) is a permanent residential permit which can be obtained through the investment in the brand […]

First EU Legislation on cryptocurrency: MICA

On 20th of April 2023, the European Parliament has finally voted and adopted the new legislative changes in the European Union concerning cryptocurrency in the form of the Markets in Crypto Assts (MICA) Regulation. Moreover, since MICA is the Regulation, it is directly applicable among the Member States without a need for any additional transposition […]

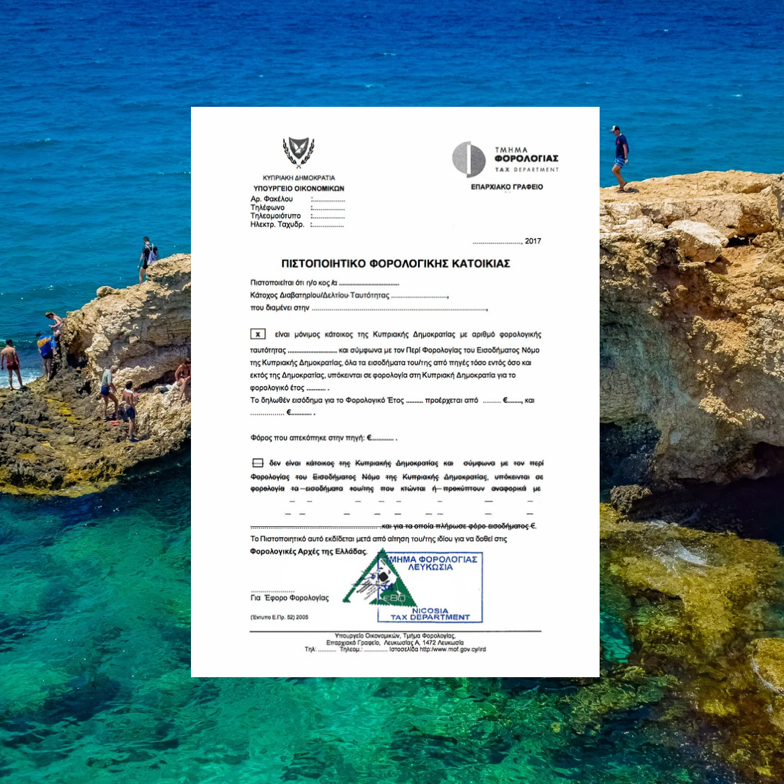

Tax Residency Certificate: Why do you need it?

Tax Residency Certificate (TRC) is a certificate issued by Cyprus Tax Authorities confirming the tax residency of the person in the Republic of Cyprus in a relevant year and is required for the purposes of benefiting from the application of double tax treaties and be in compliance with the local tax requirements. Some of the […]

Proposal for VAT legislation concerning the new buildings and apartments

When purchasing a new property in Cyprus, a buyer pays 19% VAT, which is a standard rate. However, for a purchase of a secondary property or a new one from developer, which has construction permit issued before 1st of May 2004 – the buyer is not obliged to pay VAT. The enactment of the Law […]