𝐇𝐨𝐰 𝐭𝐨 𝐜𝐨𝐧𝐟𝐢𝐫𝐦 𝐲𝐨𝐮𝐫 𝐍𝐨𝐧-𝐃𝐨𝐦 𝐬𝐭𝐚𝐭𝐮𝐬?

A person who is a tax resident in Cyprus is liable to pay Cyprus Income Tax (CIT) on their worldwide income, from all sources.

Additionally, domiciled residents of Cyprus pay a Special Defense Contribution (SDC) on their passive income derived from dividends, interest, and rentals as per the following rates:

- Dividends – 17%

- Interest Income – 30%

- Rental Income – 3% of the 75% of gross rental, effective rate 2.25%

The Non-Dom Status in Cyprus is a tax regime that enables non-domiciled tax residents to effectively reduce their tax obligations by exempting them from Special Defense Contribution (SDC) for a period of 17 years.

Consequently, these individuals -when receiving dividends – are not subject to any taxes. Instead, they are solely liable for a contribution of 2.65% towards the General Health System, with a maximum cap of 4,770 EUR as payable contributions.

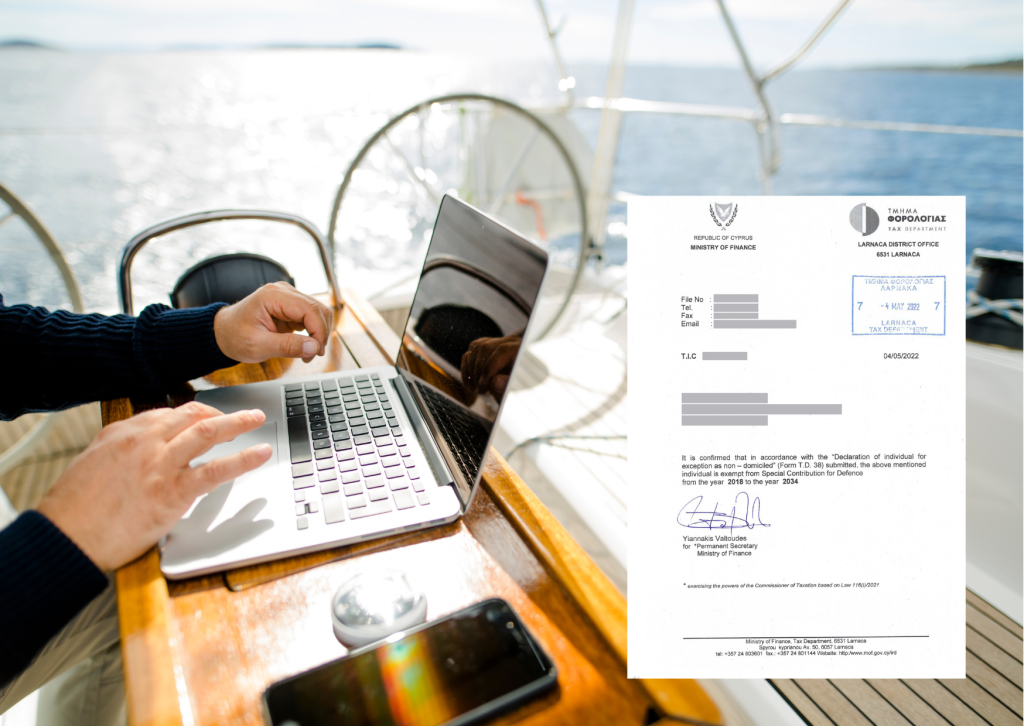

Obtaining non-domicile status involves acquiring a certificate from the Tax Authorities, a process that typically takes around three weeks following the submission of the application and all required documentation.

Who is eligible for Non-Dom Status?

The test starts with the following questions:

1.Has the individual been Cyprus tax resident for 17 years or more out of the last 20 years prior to the current tax year of assessment?

No, then move to question 2.

Yes, then the individual is Domiciled in Cyprus

2. Does the individual have a Cyprus domicile of origin?

Yes, move to question 3.

No, then the individual is considered as Non-Dom.

3. Has the individual been tax resident outside of Cyprus for the entire 20 consecutive years from 1995 until 2014?

Yes, then the individual is considered a Non-Dom.

No, move onto question 4.

4. Has the individual acquire and still maintains a domiciled of choice outside Cyprus?

Yes, move to question 5.

No, the individual is domiciled in Cyprus.

5. Has the individual been a non-Cyprus Tax resident for any 20 years consecutive period?

Yes, then the individual is considered a Non-Dom.

No, then individual is considered as domiciled in Cyprus.

How can IBCCS TAX help?

IBCCS TAX can assist you in obtaining Non-Dom Status and Tax Residency Certificate in Cyprus, providing you with access to a tax-efficient regime, attractive tax rates, and numerous exemptions.

Our expert team can handle your application on your behalf, ensuring a smooth experience.