Forward

As part of the overall exertion to improve Cyprus’ attractiveness as an international business and financial center, and in order to remain highly compliant as a traditional jurisdiction, the House of Representatives on 16 July 2015 passed a number of new laws.

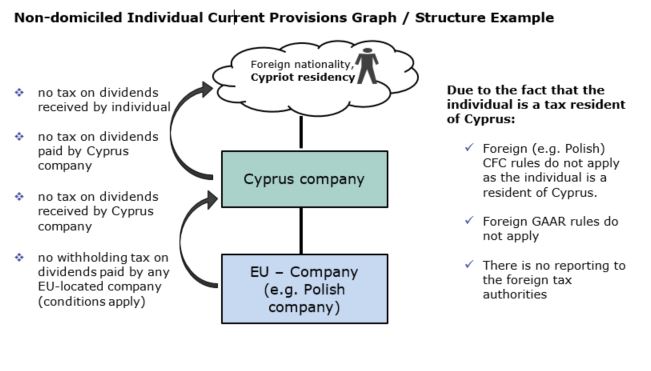

One of the changes, introduced the new status of a “non-domicile” (non-dom) individual, with tax exemptions over dividends and interest earned by qualifying “non-doms”. With this amendment, individuals who have non-dom status are no longer subject to Special Defence contribution (SDC) noting, as well, that the new law creates an attractive tax environment for non-doms residing in Cyprus.

Cyprus Tax Resident

An individual is considered a Cyprus Tax Resident, based solely on the number of days spent on the island, that is, if they are physically present on the island for 184 days or more during a calendar year; reason being it is not relevant, nor is it a condition that a Cyprus tax resident individual owns or rents accommodation in Cyprus.

Prior to above mentioned amendment, Cyprus tax resident individuals earning Cyprus or foreign sourced income in the form of dividends or “passive” interest, were subject to Cyprus Special Defence Contribution “SDC”, at the following rates:

- 30% on passive interest income;

- 17% on dividend income;

- 3% on 75% of rental income;

The SDC law also included provisions for the deemed distribution of profits of Cypriot tax resident companies where the shareholders (beneficiaries) of such companies are Cyprus tax resident individuals.

Non Domiciled Individuals are now exempt from defence tax therefore they are exempt from taxation on both dividends and any passive interest that they receive.

Non-domiciled Individual Defined

In accordance with the Wills and Succession Law, an individual can be considered as domiciled in Cyprus by way of (i) domicile of origin or (ii) by domicile of choice. That is, the domicile received by him / her at birth; or the domicile acquired or retained by him / her by own act / choice, respectively.

- For the purposes of the SDC Law, a domiciled individual in Cyprus who received the status at birth, is domiciled in Cyprus with the following exemptions:

- 1. the individual was NOT a Cyprus tax resident for at least 20 consecutive years prior to the introduction of the amendment to the SDC Law.

- 2. the individual has obtained and maintains a domicile of choice outside Cyprus, provided that he was NOT a Cyprus tax resident for a period of 20 consecutive years, prior the tax year of assessment.

- An individual who has been a tax resident of Cyprus for at least 17 years out of the last 20 years prior to the tax year will be considered to be “domiciled in Cyprus” and as such will be subject to special contribution for defence from the 18th year.

- Notwithstanding the above:

- an individual may acquire a domicile of choice with his establishment in any country outside Cyprus with the intention of the permanent or indefinite residence in such a country;

- a domicile of choice is maintained until abandoned in which case a new domicile of choice is acquired or the domicile of origin is reinstated.

With the recent amendment, the SDC law will apply to an individual only if he or she is both a resident for tax purposes in Cyprus and is also domiciled in Cyprus.

Advantages of the new regime

Individuals already living in Cyprus and who are Cyprus tax residents qualifying as non-doms, will immediately see a tax saving of 17% on dividends, 30% on bank deposit interest and, 3% on rental income noting in more detail the following advantages:

- no Cyprus tax is payable on receipt of dividend income from any company registered anywhere in the world;

- no Cyprus tax is payable on receipt of interest income from anywhere in the world;

- no SDC is payable on rental income;

- the deemed distribution rules on profits from Cyprus tax resident companies will not apply to non-Cyprus domiciled individuals.

As such, a Cyprus tax resident individual who is not domiciled in Cyprus (non-dom) will NOT be subject to the SDC in Cyprus on any interest, rents or dividends (whether actual or deemed) regardless of the source, and regardless of whether such income is remitted to a bank account or used in Cyprus.

At IBCCS we are happy to support individuals to examine whether they are entitled to the non-dom status in Cyprus. We are also happy to assist with setting-up a required structure and assist from the legal and tax point of view in order to eliminate the potential tax liability and maximise future tax gains.

For enquiries contact us by email on [email protected] or call our office in Cyprus directly on +357 222 58 777.

Panagiotis Georgiou

22 April 2016