Annual Levy for the year 2023

We would like to bring to your attention that according to the Cyprus Company Law, Cap. 113 all Cyprus Companies are subject to an annual government levy of € 350 payable by 30.06.2023. Non-payment of the annual government levy will result in penalties and the de-registration (strike off) of the company from the registry of Cyprus companies. Noting […]

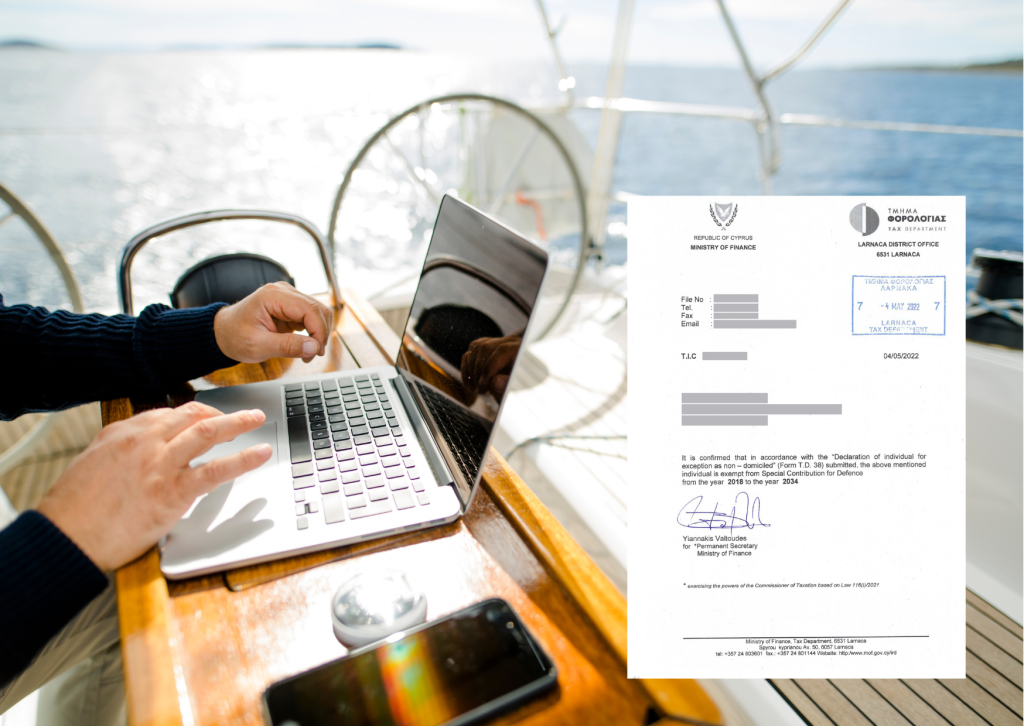

Non – Domicile Regime in Cyprus

𝐇𝐨𝐰 𝐭𝐨 𝐜𝐨𝐧𝐟𝐢𝐫𝐦 𝐲𝐨𝐮𝐫 𝐍𝐨𝐧-𝐃𝐨𝐦 𝐬𝐭𝐚𝐭𝐮𝐬 in Cyprus? A person who is a tax resident in Cyprus is liable to pay Cyprus Income Tax (CIT) on their worldwide income, from all sources. Additionally, domiciled residents of Cyprus pay a Special Defense Contribution (SDC) on their passive income derived from dividends, interest, and rentals as per the following […]

New Immigration Rules for Investment Visa in Cyprus

On 2nd of May 2023, in accordance with the Regulation 6.2 of the Alien and Immigration Regulations, the new requirements for the investment scheme have been officially adopted after the revision by the Council of the Ministers. Category 6.2 (Fast Track Residence) is a permanent residential permit which can be obtained through the investment in the brand […]

First EU Legislation on cryptocurrency: MICA

On 20th of April 2023, the European Parliament has finally voted and adopted the new legislative changes in the European Union concerning cryptocurrency in the form of the Markets in Crypto Assts (MICA) Regulation. Moreover, since MICA is the Regulation, it is directly applicable among the Member States without a need for any additional transposition […]

Legal obligations and current changes in the offshore jurisdictions

The recent changes in the offshore jurisdictions for the companies as well the main legal obligations are important to be analysed for those, who are planning to incorporate a company or already have the company in the offshore jurisdiction. In the corporate context, an offshore entity is the company, which business activity takes place outside […]

Imposition of 0.4% Tax on Cyprus immovable property sales and shares

On 27 October 2022, the law regulating the levying of a 0.4% tax on all sales of immovable property with the proceeds going to financially support Greek Cypriot refugees has been published in the Official Gazette by that amending the provisions of the Central Agency for Equal Distribution of Burdens (Creation, Objects, Responsibilities, and Other […]

Unpaid Annual Levy and possible strike off

On 3 November 2022 the Department of Registrar of Companies and Intellectual Property (“ROC”) announced that it intends to proceed with the 𝐝𝐞𝐫𝐞𝐠𝐢𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 𝐨𝐟 𝐜𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬, 𝐢𝐟 𝐭𝐡𝐞𝐲 𝐟𝐚𝐢𝐥𝐞𝐝 𝐭𝐨 𝐬𝐞𝐭𝐭𝐥𝐞 𝐭𝐡𝐞 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐟𝐨𝐫 𝐚𝐧𝐧𝐮𝐚𝐥 𝐥𝐞𝐯𝐲. The ROC may remove a company from the register if the company fails to pay the annual fee provided for […]

Tax Exemptions on the First Employment: Clarifications

On 01.11.2022 the Tax Department has issued the Circular (Νο. 10/2022) for the purposes of clarifying new tax income exemptions for the practical application as well as conceptualizing the term “first employment”. By virtue of the Circular, it should be noted that the first employment of an individual ceased to exist or never existed in […]

Clarification on Bilateral Agreement between Cyprus and United States

On 13.10.2022 the Cyprus Tax Department notified all legal entities and their official representatives that the Bilateral Competent Authority Arrangement (CAA) for the exchange of Country-by-Country (CbC Reports) between Cyprus and the United States of America for Reporting Fiscal Years will be effective on or after 01.01.2022. As a result, if the Ultimate Parent Entity […]

Provisional Tax Liability by Newly Incorporated Companies

According to the recent interaction between the Commissioner of Taxation and the Tax Compliance Committee of ICPAC (“The Institute of Certified Public Accountants of Cyprus”), no penalties or interest should be imposed on the entity which was incorporated within the period from 31.07.2022 (first installment of the provisional tax) to 31.12.2022 ( second installment) in […]