Unpaid Annual Levy and possible strike off

On 3 November 2022 the Department of Registrar of Companies and Intellectual Property (“ROC”) announced that it intends to proceed with the 𝐝𝐞𝐫𝐞𝐠𝐢𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 𝐨𝐟 𝐜𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬, 𝐢𝐟 𝐭𝐡𝐞𝐲 𝐟𝐚𝐢𝐥𝐞𝐝 𝐭𝐨 𝐬𝐞𝐭𝐭𝐥𝐞 𝐭𝐡𝐞 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐟𝐨𝐫 𝐚𝐧𝐧𝐮𝐚𝐥 𝐥𝐞𝐯𝐲. The ROC may remove a company from the register if the company fails to pay the annual fee provided for […]

Tax Exemptions on the First Employment: Clarifications

On 01.11.2022 the Tax Department has issued the Circular (Νο. 10/2022) for the purposes of clarifying new tax income exemptions for the practical application as well as conceptualizing the term “first employment”. By virtue of the Circular, it should be noted that the first employment of an individual ceased to exist or never existed in […]

Clarification on Bilateral Agreement between Cyprus and United States

On 13.10.2022 the Cyprus Tax Department notified all legal entities and their official representatives that the Bilateral Competent Authority Arrangement (CAA) for the exchange of Country-by-Country (CbC Reports) between Cyprus and the United States of America for Reporting Fiscal Years will be effective on or after 01.01.2022. As a result, if the Ultimate Parent Entity […]

Provisional Tax Liability by Newly Incorporated Companies

According to the recent interaction between the Commissioner of Taxation and the Tax Compliance Committee of ICPAC (“The Institute of Certified Public Accountants of Cyprus”), no penalties or interest should be imposed on the entity which was incorporated within the period from 31.07.2022 (first installment of the provisional tax) to 31.12.2022 ( second installment) in […]

CYPRUS: PROVISIONAL TAX 2015 – FINAL PAYMENT

We would like to remind our clients and contacts about the upcoming deadline for submission of the 2nd declaration concerning provisional tax for the year 2015. Computation of Temporary Tax According to art. 24 of the Assessment and Collection of Taxes Law No.4 of 1978, as amended, the official deadline for submission of the Provisional […]

Annual Levy of EUR 350.00 – companies registered in Cyprus

Please be informed that as per the Article 391 of the Companies law (as amended Law No. 6(I)/2013), it is obligatory to pay the annual fee (Annual Levy) for all companies registered in Cyprus. The fee equals to EUR 350.00 (three hundred and fifty euros) and has to be paid to the Registrar of Companies […]

Tax avoidance vs. tax evasion

The difference between those two is crucial. While tax avoidance is legal, tax evasion is not. It is understandable that the local governments try to fight with both, however very often it is a long-term and complicated process. In the meantime, the taxpayers might enjoy their attempts to pay less taxes. Let’s look at both […]

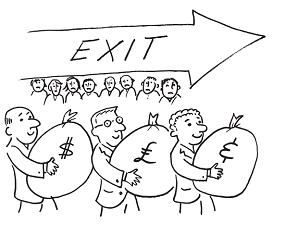

Why companies & individuals go offshore?

There are various benefits for companies and individuals going offshore, but the most popular one is the possibility to reduce or avoid taxes. Tax avoidance was, is, and will be the most important reason for going offshore. We can mention some other reasons like e.g. protection of assets, holding of investments, using the offshore company […]