Tax Reform in Cyprus – First Proposals and Potential Impact Introduction

Cyprus is preparing to roll out significant tax reforms designed to modernise its tax system while preserving its status as an appealing business destination. UPDATE 2026: The new tax law was just approved in December 2025 and came into effect in Cyprus on January 1st 2026. Not all proposed changes made it through – so […]

ATAD 3: economic substance requirements

In December 2021, the European Commission published the first proposal for the Anti-Tax Avoidance Directive 3 (ATAD 3). Its goal is to tackle the abuse of companies that do not carry out any economic activities – namely shell entities. Therefore, the directive is also known as the “Unshell Directive”. The proposal was approved by the […]

Marshall Islands & Substance Reporting

As of November 1, 2023, the Trust Company of the Marshall Islands has implemented a penalty fee of USD 500 for entities failing to adhere to Economic Substance Reporting (ESR). This move comes as part of the country’s commitment to upholding international standards and remaining in the European Union’s whitelist. Reporting obligation Since 2020 […]

UAE Tax Landscape: 9% CIT

The United Arab Emirates is no longer a zero-tax jurisdiction. We were informing about this major shift in our article, back in June 2023: https://ibccs.tax/uae-corporate-tax/ Certain exemptions apply, however many of the businesses will now pay a corporation tax. On-shore entities, as well as Free Zone entities involved in transactions with on-shore entities, will be subject […]

Legal obligations and current changes in the offshore jurisdictions

The recent changes in the offshore jurisdictions for the companies as well the main legal obligations are important to be analysed for those, who are planning to incorporate a company or already have the company in the offshore jurisdiction. In the corporate context, an offshore entity is the company, which business activity takes place outside […]

Imposition of 0.4% Tax on Cyprus immovable property sales and shares

On 27 October 2022, the law regulating the levying of a 0.4% tax on all sales of immovable property with the proceeds going to financially support Greek Cypriot refugees has been published in the Official Gazette by that amending the provisions of the Central Agency for Equal Distribution of Burdens (Creation, Objects, Responsibilities, and Other […]

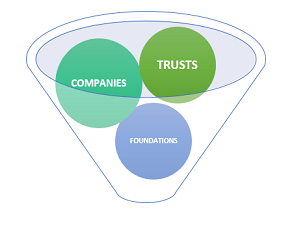

Types of entities available offshore

In typical offshore jurisdiction, the types of entities available often include the same entities (like various types of companies and partnerships) which are available elsewhere. They may however have different characteristics & regulations and may be treated differently by local law than the same entities in other countries. While companies are the most popular vehicles […]

Offshore financial centre – defined

There are many debates on how the ‘offshore financial centre’ should be defined. Should people say ‘offshore centre’, ‘tax haven’, ‘low tax jurisdiction’, ‘offshore zone’ or the other combination? And what do they really mean? They all relate to similar area, but there are slight differences between some of them (which I will explain in […]