Marshall Islands & Substance Reporting

As of November 1, 2023, the Trust Company of the Marshall Islands has implemented a penalty fee of USD 500 for entities failing to adhere to Economic Substance Reporting (ESR). This move comes as part of the country’s commitment to upholding international standards and remaining in the European Union’s whitelist. Reporting obligation Since 2020 […]

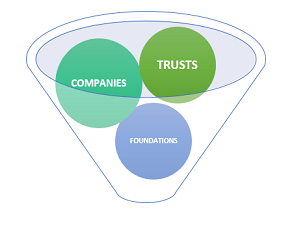

Types of entities available offshore

In typical offshore jurisdiction, the types of entities available often include the same entities (like various types of companies and partnerships) which are available elsewhere. They may however have different characteristics & regulations and may be treated differently by local law than the same entities in other countries. While companies are the most popular vehicles […]

Why companies & individuals go offshore?

There are various benefits for companies and individuals going offshore, but the most popular one is the possibility to reduce or avoid taxes. Tax avoidance was, is, and will be the most important reason for going offshore. We can mention some other reasons like e.g. protection of assets, holding of investments, using the offshore company […]

Offshore financial centre – defined

There are many debates on how the ‘offshore financial centre’ should be defined. Should people say ‘offshore centre’, ‘tax haven’, ‘low tax jurisdiction’, ‘offshore zone’ or the other combination? And what do they really mean? They all relate to similar area, but there are slight differences between some of them (which I will explain in […]