The United Arab Emirates (UAE) is known for being business-friendly, having low taxes, and being in a great location. This makes it a popular choice for people who want to start a business. If you want to start a business in the UAE, this step-by-step guide will help you understand the process easily.

Introduction

Table of Contents

ToggleStarting a business in a new country can seem hard. However, the UAE makes it simple for entrepreneurs because of its modern systems, clear processes, and helpful government policies. In this guide, we will show you the steps to set up a business in the UAE, from choosing your business activity to getting your business license. This way, you will be ready for every part of the process.

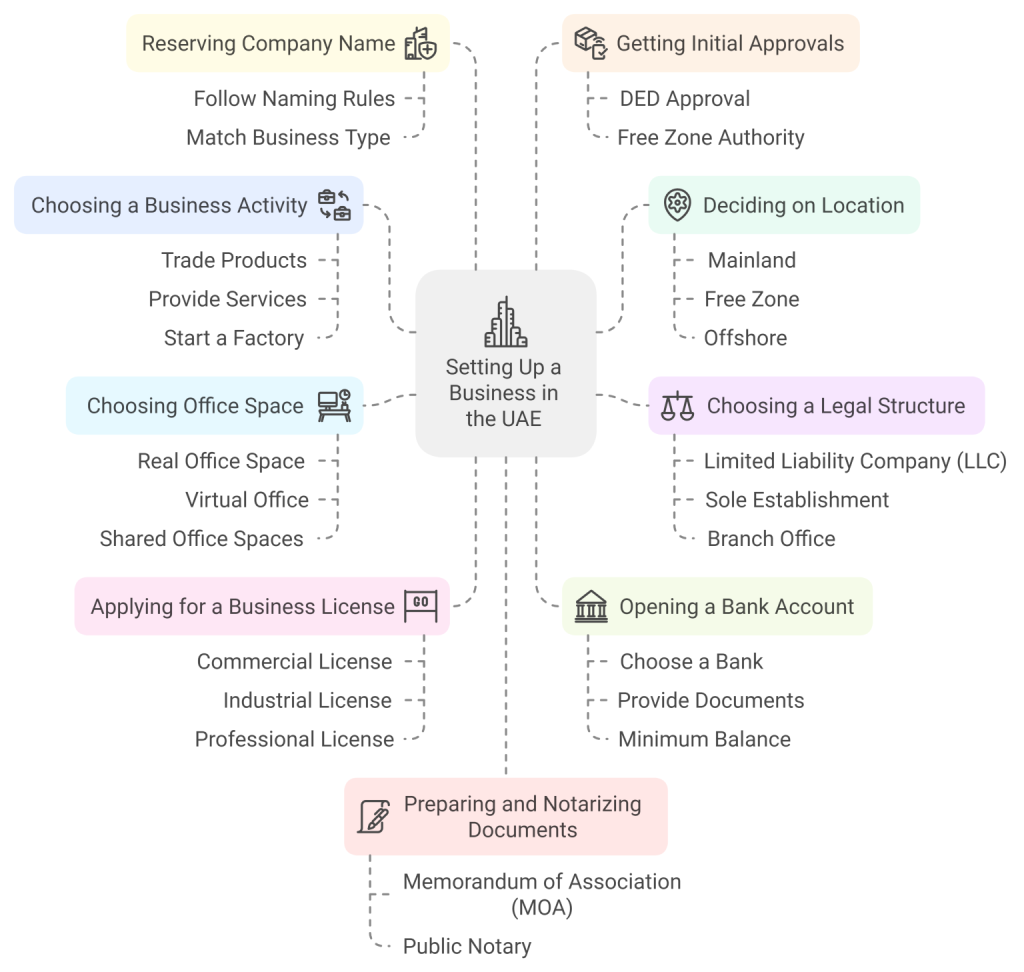

Step-by-Step Guide to Set Up a Business in the UAE

Step 1: Choose a Business Activity

First, you need to decide what type of business you want to run. The type of business you choose will affect the license you need and the rules you must follow. Whether you want to trade products, provide a service, or start a factory, choosing the right type of business is very important. For more details on business activities and licenses, visit the Department of Economic Development (DED) website.

Step 2: Decide on the Location

Next, you need to decide where to set up your business in the UAE. You have three main options: Mainland, Free Zone, or Offshore. Each option has its own advantages:

- Mainland: This option lets you do business anywhere in the UAE and internationally. Therefore, it is ideal if you want to reach a wide market.

- Free Zone: It offers 100% foreign ownership, tax benefits, and an easy setup process. However, it limits your activities to within the free zone. Learn more in our guide on Corporate Structuring in the UAE.

- Offshore: This is best for businesses that manage operations outside of the UAE and do not need a physical office.

Step 3: Choose a Legal Structure

After deciding on the location, you need to pick the legal structure of your company. Here are some common types:

- Limited Liability Company (LLC): This structure is popular for most businesses in the mainland.

- Sole Establishment: It is good for people offering services on their own.

- Branch Office: This type is suitable for existing companies that want to expand to the UAE.

Each type has its own rules, so you should choose one that works best for your business. Also, make sure the structure fits your future plans.

Step 4: Reserve Your Company Name

Then, you need to choose and reserve a name for your business in the UAE. The name must follow certain rules—such as no bad language, no reference to religion, and it cannot be the same as another registered business. Also, the name should match the type of business you are doing. Therefore, take time to think about a name that represents your brand well.

Step 5: Get Initial Approvals

After reserving the name, you need to get approvals from the authorities before moving ahead. This includes getting approval from the Department of Economic Development (DED) or the free zone authority. At this stage, you will submit details about your business, its owners, and the name you chose. Once you have these initial approvals, you can move to the next steps.

Step 6: Prepare and Notarize Documents

After you get the initial approval, prepare important documents like the Memorandum of Association (MOA). These documents show who owns the company and how it will be managed. You must have these documents signed and approved by a public notary so that your business can move forward legally. Without notarized documents, you cannot register your company.

Step 7: Choose an Office Space

All businesses in the UAE must have a physical address. You can choose between a real office space or a virtual office, depending on what you need. Free zones often have flexible options, like shared office spaces, which are good for new businesses. Moreover, having an office is needed to complete the company setup. Therefore, choose an office that fits your budget and business size.

Step 8: Apply for a Business License

Once you complete the earlier steps, you can now apply for the right business license. There are three main types of licenses:

- Commercial License: For trading goods.

- Industrial License: For manufacturing or production.

- Professional License: For service-based businesses like consulting.

The application process might be a little different depending on where you set up. However, you will need to provide documents like the MOA, office lease, and details about the owners. After you collect all the required documents, submit them to the relevant authority.

Step 9: Register with Authorities

After you receive your business license, you also need to register with the Chamber of Commerce. This step is needed to make sure your business is legally allowed to operate in the UAE. Furthermore, it gives you the permissions needed to conduct business activities. As a result, you will be able to operate your business without any legal issues.

Step 10: Open a Bank Account

Opening a business bank account is very important to manage your money. The process includes choosing a bank, providing documents like your trade license and owner details, and going through the bank’s checks. Some banks may require a minimum balance. For more information, check out our Bank Account Opening Services. Once your bank account is open, you will be able to manage your business finances more easily.

Step 11: Apply for Visas

Finally, after your company is set up, you can apply for investor visas for yourself and employee visas for your staff. The UAE offers these visas so that business owners and workers can live and work in the country. You need to submit documents, take a medical test, and complete biometric verification. Once the visas are approved, you and your employees can start working in the UAE. Learn more about Immigration / Visa services in the UAE.

Tips for Entrepreneurs Setting Up a Business in the UAE

- Choose the Right Sponsor or Agent: If you are setting up a mainland business, you may need a local sponsor. Therefore, you should choose someone who has a good reputation and knows your industry well. This will help you avoid future problems.

- Understand the Costs: It is also important to budget for setup costs, license fees, visa expenses, and office rent. Also, having a clear understanding of these costs will help you plan better.

- Stay Compliant: The UAE has strict rules for businesses, including Anti-Money Laundering (AML) requirements and Economic Substance Regulations (ESR). Working with a professional firm can help you stay within the rules and avoid penalties. Therefore, do not skip compliance checks and always be up-to-date with the latest regulations.

Conclusion

Setting up a business in the UAE can be simple if you follow these steps. The UAE provides great opportunities for entrepreneurs, thanks to its tax benefits, strategic location, and business-friendly environment. Therefore, if you’re ready to start your business journey, take the first step today!

Need help getting started? Contact IBCCS TAX for expert assistance in setting up your business in the UAE, from choosing the right location to handling all the paperwork.