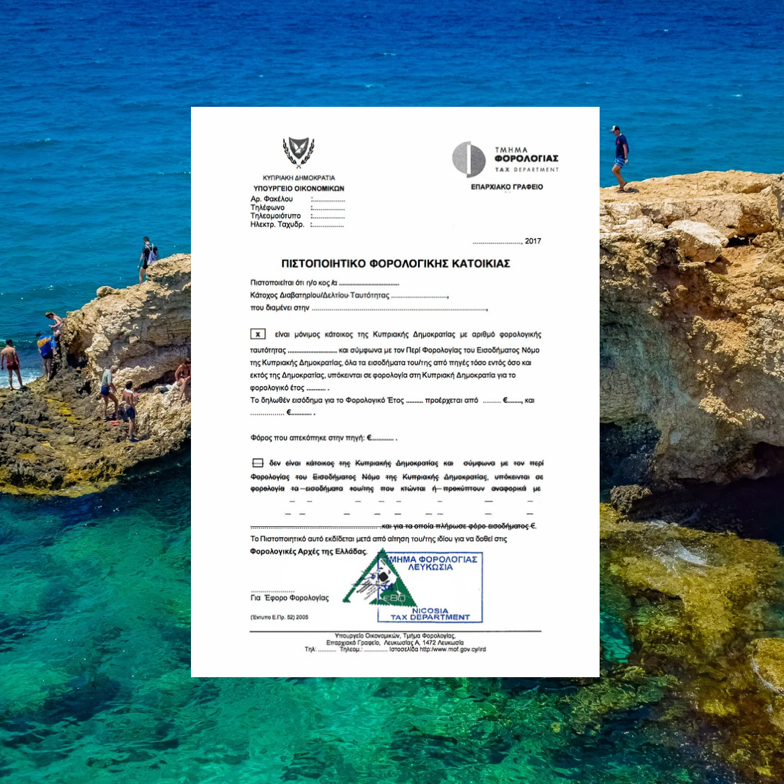

Tax Residency Certificate (TRC) is a certificate issued by Cyprus Tax Authorities confirming the tax residency of the person in the Republic of Cyprus in a relevant year and is required for the purposes of benefiting from the application of double tax treaties and be in compliance with the local tax requirements.

Some of the benefits are, but not limited to: the elimination of double taxation, as Cyprus offers a credit relief even in the absence of double tax treaty, and no taxation on the sale of securities, including shares, stocks and etc.

The are two ways of establishing your Tax Residency: 183 days rule and 60 days rule. The first applies to the instances where an individual spends 183 days or more in Cyprus, whereas the last applies in cases when an individual spends in the Republic of Cyprus 60 days. Requirements apply to the 60 days rule that need to be fulfilled.

IBCCS TAX suggests to all our clients, who have switched their tax residency or persons who possess foreign passports alongside with the residence permit of Cyprus – to obtain and/or apply to such document every year as a proof for the foreign authorities of their tax residency.

How can IBCCS TAX help?

IBCCS TAX can assist you in obtaining Tax Residency Certificate in Cyprus, providing you with access to a tax-efficient regime, attractive tax rates, and numerous exemptions. Our expert team can handle your application on your behalf, ensuring a smooth experience.