Extension to the filing date of Income Tax Return (IR1 2022)

We would like to inform you that the deadline for the submission of the 2022 Personal Income Tax Return (T.D. 1 Form) in Cyprus has been extended until 2 October 2023, as per the decree (No.183/2023) issued on 9 June 2023. The extension also applies to the payment of the related income tax due via self-assessment. […]

Tax-Free No More: Clarifying UAE’s Ground-breaking Corporate Tax Shift

A major shift is happening in UAE. The Federal Tax Authority (FTA) will introduce a 9% corporation tax. We are explaining the implications of this substantial policy change. This new mandate is applicable to all business entities across the UAE, including those within onshore and Free Zone jurisdictions. Who is affected? On-shore entities, as […]

Annual Levy for the year 2023

We would like to bring to your attention that according to the Cyprus Company Law, Cap. 113 all Cyprus Companies are subject to an annual government levy of € 350 payable by 30.06.2023. Non-payment of the annual government levy will result in penalties and the de-registration (strike off) of the company from the registry of Cyprus companies. Noting […]

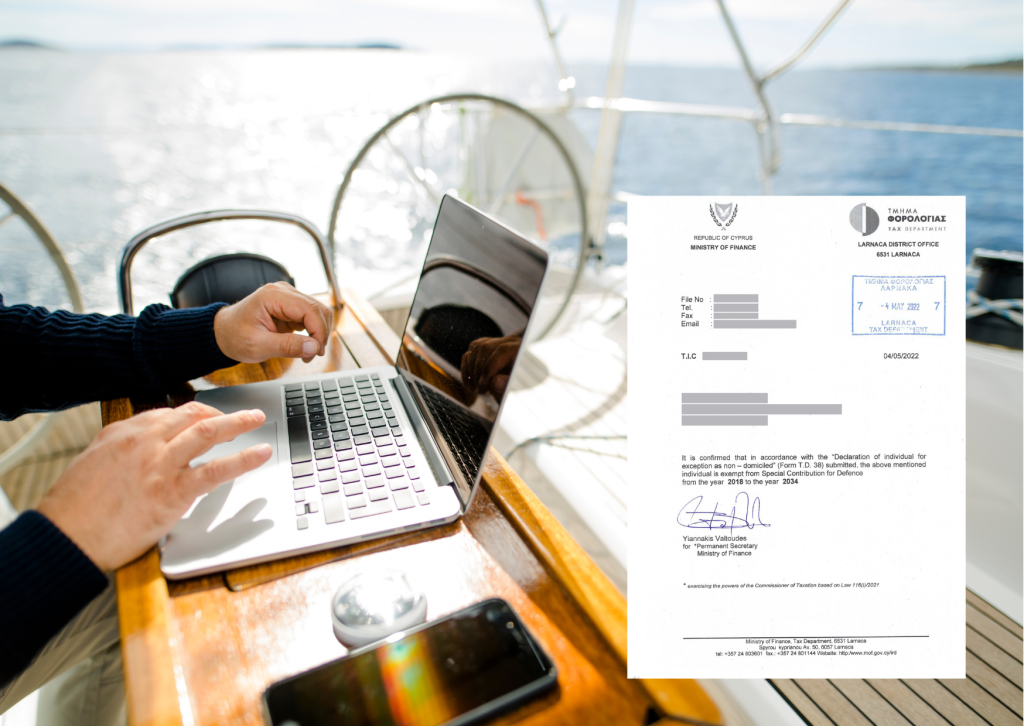

Non – Domicile Regime in Cyprus

𝐇𝐨𝐰 𝐭𝐨 𝐜𝐨𝐧𝐟𝐢𝐫𝐦 𝐲𝐨𝐮𝐫 𝐍𝐨𝐧-𝐃𝐨𝐦 𝐬𝐭𝐚𝐭𝐮𝐬 in Cyprus? A person who is a tax resident in Cyprus is liable to pay Cyprus Income Tax (CIT) on their worldwide income, from all sources. Additionally, domiciled residents of Cyprus pay a Special Defense Contribution (SDC) on their passive income derived from dividends, interest, and rentals as per the following […]

New Immigration Rules for Investment Visa in Cyprus

On 2nd of May 2023, in accordance with the Regulation 6.2 of the Alien and Immigration Regulations, the new requirements for the investment scheme have been officially adopted after the revision by the Council of the Ministers. Category 6.2 (Fast Track Residence) is a permanent residential permit which can be obtained through the investment in the brand […]

First EU Legislation on cryptocurrency: MICA

On 20th of April 2023, the European Parliament has finally voted and adopted the new legislative changes in the European Union concerning cryptocurrency in the form of the Markets in Crypto Assts (MICA) Regulation. Moreover, since MICA is the Regulation, it is directly applicable among the Member States without a need for any additional transposition […]

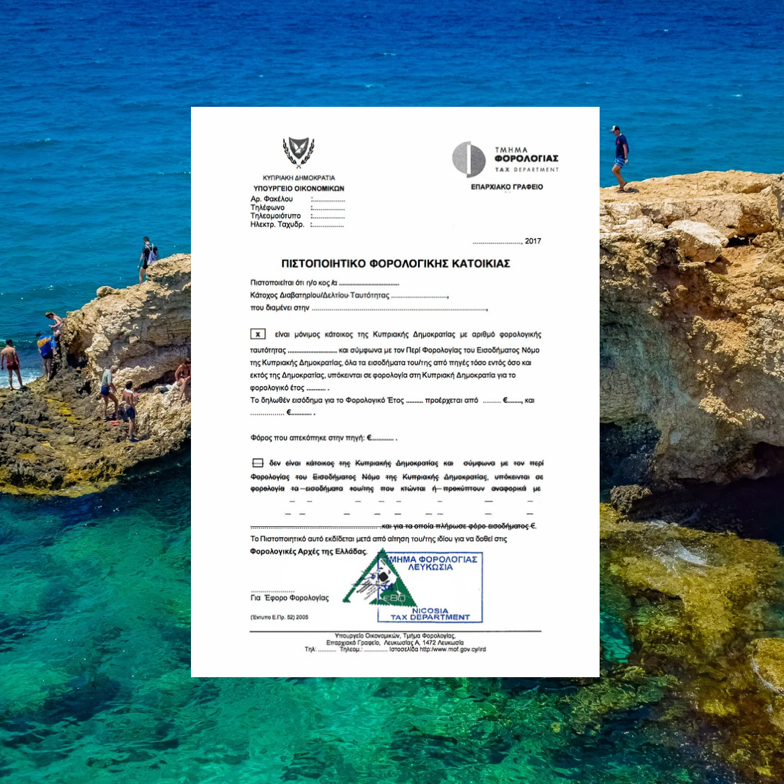

Tax Residency Certificate: Why do you need it?

Tax Residency Certificate (TRC) is a certificate issued by Cyprus Tax Authorities confirming the tax residency of the person in the Republic of Cyprus in a relevant year and is required for the purposes of benefiting from the application of double tax treaties and be in compliance with the local tax requirements. Some of the […]

Proposal for VAT legislation concerning the new buildings and apartments

When purchasing a new property in Cyprus, a buyer pays 19% VAT, which is a standard rate. However, for a purchase of a secondary property or a new one from developer, which has construction permit issued before 1st of May 2004 – the buyer is not obliged to pay VAT. The enactment of the Law […]

Cyprus Companies Law: provisions which you should know about

Prohibition of acting as sole director and secretary As per to the Companies Law, Cap 113 (the ‘Law’), every company in Cyprus is obliged to have a director and secretary, noting that the latter is responsible for the efficient administration and operations of the company as well as compliance with local legal requirements. However, as […]

How third country nationals can be employed in Cyprus? Foreign company formation

Non – EU citizens can be eligible for the employment in the Republic of Cyprus providing if they are employed at the foreign entities. The scope of “foreign entities” refers to the instances where: Most importantly, this type of visa, contrary to Temporary Residential Permit or Permanent Residential Permit, allows a third country national to […]