Introduction

Table of Contents

ToggleStarting a business in the UAE has many opportunities. But, choosing the right business structure is key to success. The UAE offers different business structures to fit various needs. Whether you want full control or tax benefits, this guide will help you decide.

Why Business Structure in the UAE Matters

The business structure you choose affects your liability, ownership, taxes, and growth. You need to understand each type to see what fits your goals. The UAE’s business environment is always changing. Knowing the different business structures is important for growth and compliance. To learn more, visit the Ministry of Economy – Business Setup Regulations.

Learn more about How to Set Up a Business in the UAE

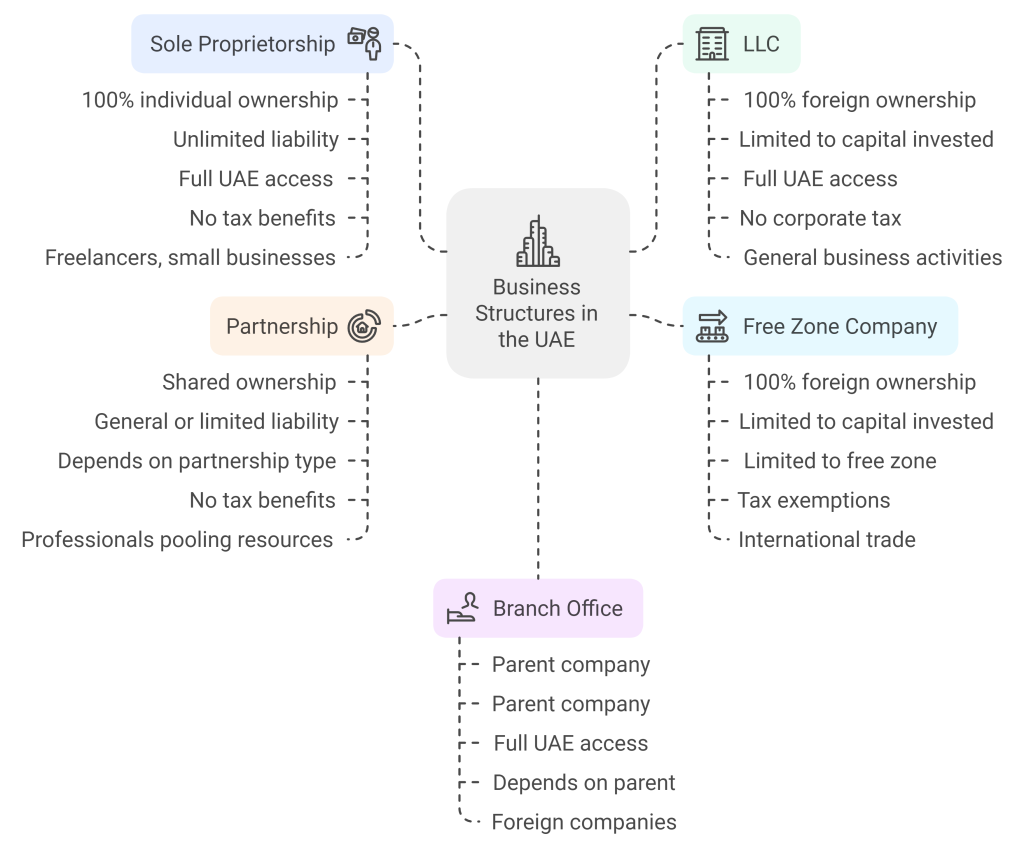

Types of Business Structures in the UAE

1. Sole Proprietorship

A sole proprietorship is the simplest type of business in the UAE. One person owns and runs the business. You have full control over decisions and profits. It is best for freelancers or small businesses. But, you are also fully liable for debts. This means personal assets are at risk if the business fails.

2. Limited Liability Company (LLC)

An LLC is popular for both local and foreign investors. In the past, an LLC needed a local sponsor to hold 51% ownership. Now, the law allows 100% foreign ownership in many sectors. This means entrepreneurs can have full control. An LLC also offers limited liability. This protects your personal assets from company debts.

For those looking for flexibility and lower risk, an LLC is a great choice. Contact IBCCS TAX for Expert Assistance. We can help with all the legal steps to set up an LLC and ensure compliance.

3. Free Zone Company in the UAE

A free zone setup is ideal if you want full ownership. Free zones offer 100% foreign ownership and tax breaks. The setup process is also simple. But, free zone companies cannot operate in the UAE market outside their zone unless they have a local distributor.

Benefits of a free zone setup include:

- No import or export taxes, which is great for trading.

- Full repatriation of profits and capital.

- An easy visa process for you and your employees.

If you focus on international trade or services, a free zone setup is an excellent choice.

4. Partnership

A partnership is another type of business structure. It forms when two or more people start a business. There are two main types: general and limited partnerships. In a general partnership, all partners share liability. In a limited partnership, general partners have unlimited liability. But limited partners only risk what they invest.

This type works well for people who want to share skills and resources. But, it can lead to conflicts, so clear agreements are needed.

5. Branch and Representative Offices

Foreign companies can set up a branch or representative office in the UAE. A branch office can engage in commercial activities under the parent company’s name. On the other hand, a representative office can only promote the parent company. It cannot conduct business

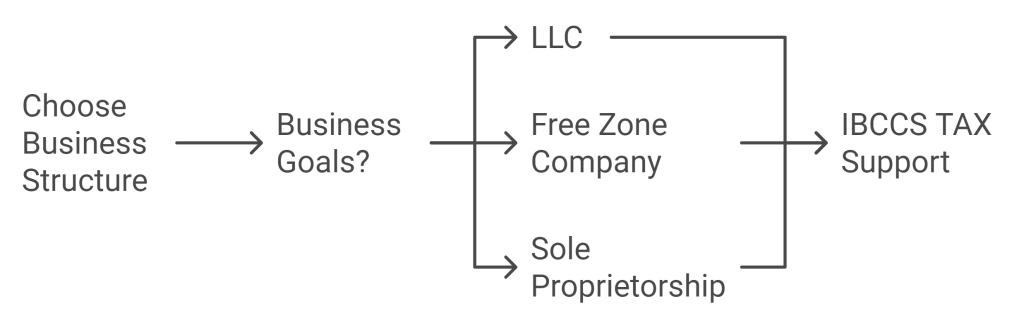

How to Choose the Right Business Structure in the UAE

Your choice depends on your goals, market, and risk level. For example:

- If you want to engage fully in the UAE market, an LLC offers great flexibility. Now, it also allows 100% foreign ownership in most sectors.

- If you want full ownership and focus on international trade, a free zone company is ideal.

- If you want complete control and are willing to take on risks, a sole proprietorship may work best.

Choosing the right structure can be complex. Regulations keep changing. IBCCS TAX helps entrepreneurs make the best choice. We offer full support from setup to compliance. Visit Our Blog for More Insights.

Learn more about Company Formation in the United Arab Emirates

Conclusion

Choosing the right business structure in the UAE is an important decision. It affects ownership, liability, taxes, and market access. Whether you are a small business owner or an international investor, there is a structure for you. IBCCS TAX is here to help you take the first step. We ensure a smooth setup and ongoing support.

Ready to start your business in the UAE? Contact us today for a consultation.