First EU Legislation on cryptocurrency: MICA

On 20th of April 2023, the European Parliament has finally voted and adopted the new legislative changes in the European Union concerning cryptocurrency in the form of the Markets in Crypto Assts (MICA) Regulation. Moreover, since MICA is the Regulation, it is directly applicable among the Member States without a need for any additional transposition […]

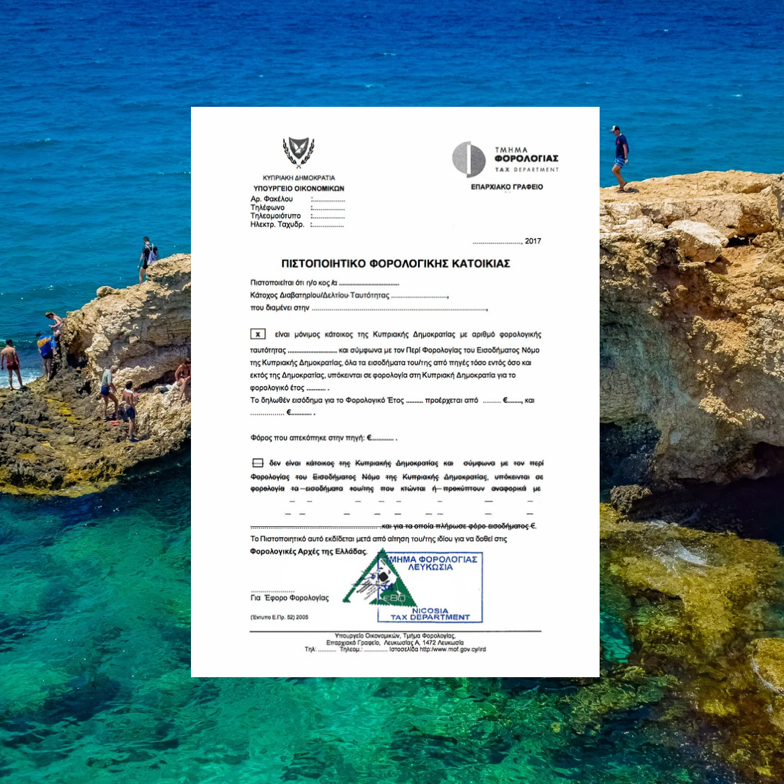

Tax Residency Certificate: Why do you need it?

Tax Residency Certificate (TRC) is a certificate issued by Cyprus Tax Authorities confirming the tax residency of the person in the Republic of Cyprus in a relevant year and is required for the purposes of benefiting from the application of double tax treaties and be in compliance with the local tax requirements. Some of the […]

Proposal for VAT legislation concerning the new buildings and apartments

When purchasing a new property in Cyprus, a buyer pays 19% VAT, which is a standard rate. However, for a purchase of a secondary property or a new one from developer, which has construction permit issued before 1st of May 2004 – the buyer is not obliged to pay VAT. The enactment of the Law […]

Cyprus Companies Law: provisions which you should know about

Prohibition of acting as sole director and secretary As per to the Companies Law, Cap 113 (the 'Law’), every company in Cyprus is obliged to have a director and secretary, noting that the latter is responsible for the efficient administration and operations of the company as well as compliance with local legal requirements. However, as […]