Home » Accountants & Accounting Services » Audit of Financial Statements for Cyprus Companies

Home » Accountants & Accounting Services » Audit of Financial Statements for Cyprus Companies

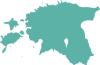

Preparing and submitting accurate financial statements is a legal obligation for companies, sole traders, and partnerships in Cyprus. To meet this requirement and ensure compliance with relevant accounting standards, IBCCS TAX collaborates with trusted partners in Cyprus to provide professional audit services. Our dedicated team, in coordination with our partner auditors, delivers accurate and independent audit reports that instil trust among stakeholders.

Audit services play a crucial role in assessing and validating the accuracy and reliability of financial statements for businesses in Cyprus. Key reasons why businesses should consider audit services include:

Businesses in Cyprus, including companies, sole traders, and partnerships, have an obligation to prepare and submit financial statements in accordance with the Companies Law of Cyprus, Partnership and Business Names Law, and relevant accounting standards.

As from 01.01.2023, The Cyprus House of Representatives has endorsed amendments to the Companies Law and the Assessment and Collection of Taxes Law. These amendments are specifically designed to streamline the audit procedures for small and medium-sized companies in Cyprus.

Following this, all small sized companies are now able to be exempt from the weight of complying with the ISAs if they meet certain criteria.

If a Cyprus company meets the below listed thresholds, then this company will be able to submit financial statements with a limited assurance review, instead of a full audit.

Thresholds for Companies:

The above thresholds must be met for at least two consecutive years.

Thresholds for Individuals:

For individuals with a turnover that does not exceed €70,000, they are exempt from preparing financial statements.

If the above thresholds are exceeded, full audit applies.

Partnerships are required to adhere to the provisions outlined in sections 118 to 122 (inclusive) of the Cyprus Companies Law. It is mandatory for partnerships to maintain accurate and up-to-date books of accounts. The partners themselves (excluding LLP partners) are individually responsible for maintaining appropriate accounting records. It is important to note that when a partner’s taxable income exceeds €70,000, the preparation of audited accounts becomes necessary.

By engaging our audit services, businesses can ensure that their financial statements meet the necessary legal and regulatory requirements, providing accurate and reliable information to stakeholders.

Through our trusted partners in Cyprus, we offer comprehensive audit services tailored to meet the specific needs of businesses in Cyprus. Our audit services include:

The audit of financial statements is a critical process for businesses in Cyprus to ensure compliance with legal obligations and maintain credibility among stakeholders. Our collaborative approach, in partnership with trusted auditors, guarantees accurate and independent audit reports that instil confidence in your financial statements.

Contact us today to discuss how our audit services can assist your business in Cyprus in meeting its legal obligations and maintaining financial transparency.

Reach out to us by clicking on the button here.

Since 2014 we’ve continually explored new ways of finding viable solutions. Our vision is to keep doing business that inspires us to create more. Our mission is to create a better everyday operating life for the businesses and to offer a wide range of tailor-made solutions.

We assist our clients in relocation and at all stages of their entrepreneurship adventure: from structuring the business in a tax-efficient manner, through the daily administration and operations of the companies.

Or receive brochure for specific topic